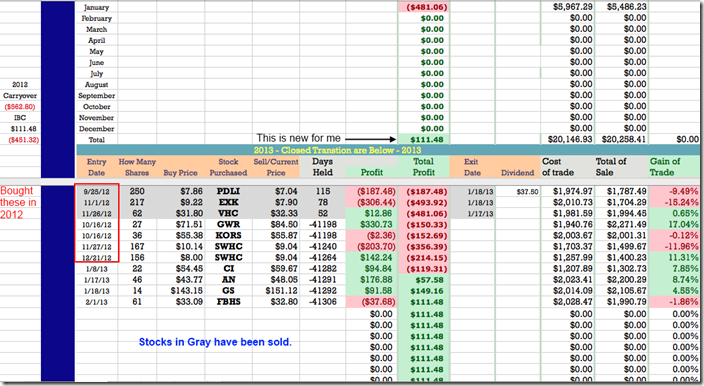

Below are the first set of numbers for 2013. If you look down the left side for a red box, those stocks were bought in 2012, so I ‘m still rolling some of those losses over. Right now in 2013, I’m 3 out of 4 to the good. This is new for me and maybe a change in luck. I work hard to stay disciplined and fight my urges to follow news and rumors, but I find it even harder with stocks. The first month, January I posted a $481 loss. Not exactly the way I envisioned it, but it was pretty normal for me. That sounds very negative and I want that to stop. Do you see the little line that says, “This is new for me?” That is were I would be if I liquidated all my positions now and that is after commission. So for the firt time in a very long time, I can say for the moment I’m in the Green, even if it’s just on paper.

SWHC – Smith and Wesson is my largest position and at first glance it looks awful, but with commission as part of my equation, I’m just $61 down. Price just crossed back over the 50 day moving average today so I’m hoping that I can ride this stock into the sunset with big profits. I expect the earnings report in March to be huge. On the downside of this picture is all the gun control talk. I just do think our Government will ever do anything because of lobbyist.

GWR – Genesee & Wyoming Rail is my big winner for now. I’m up 17% and looking at a current chart, bull flagging hopefully to breakout to the upside. GWR will report earnings 2/12/13 after the markets close and I plan to hold through earnings.

KORS – Like Smith & Wesson this has been a very hard stock to hold and I likely should have sold it for a loss awhile back. I’ve owned it since mid-October and I have nothing to show for this period of time. I’m down $3. KORS is in a very wide price channel between $46.50 to $58.00. Right now price is leaning to the upper portion of the channel. Earnings come out 2/12/13 before the market opens. My plan right now is to hold through, but I could change my mind depending on what price does between now and then.

CI – Cigna Corp is one of my favorites and one of my newer picks. I believe I found it by sorting through Healthcare stocks at the time when that sector was rolling. CI reports tomorrow morning, so wish luck.

GS – My son was looking to buy BAC and I wanted a banking stock and I felt at the time of purchase, this was the safer move. GS reported earnings on 1/16/13 so I do not have to worry about wipe lash on that news. So far so good with GS.

FBHS – I have owned before and made money and this one was been bought by a trader that I know. I liked the chart and decided to get back in again. So far it has moved a little against me but it is early in the game for this stock. Earning already reported 1/31/13, so I feel safe for now.

You will also notice down the left hand column a little area named IBC. I joined a trader page that has a paying membership to increase my knowledge base. At the time purchase, I had gotten a few stock plays from them that made me a little cash, so I gave it back to them. $359 a year. Right now in time with the carry over from 2012, the trades I’ve played with their picks since and some of my strategies, I’m down $451.00 Not to crazy about the main section of the membership that I paid for because it is not for rookies or pickers, as they call us. I want to join the area with ChessNwine, but an additional $359 is required and until I make the profit from trades, I will not surrender new capitol to their page.

No comments:

Post a Comment