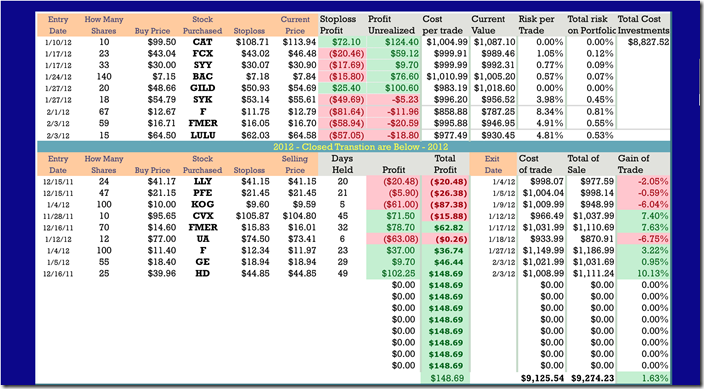

This week I was stopped out of 3 positions that put me back in the hole for the year. LULU was unfortunate, because after I got stopped out, the next 2 days it went back up to where I would have been in the money. Ford I had on a automatic buy limit order and I will not do that again. TIBX, I just screwed up the initial stop order when I bought it and gave away $22.69.

My remaining positions are mostly in good shape except for Gild. I was going to wait until the 3rd day after the original bad news and then set my stop loss at the lowest point. That has been done and even though I do not like my risk, I have accepted the risk. Just to note I have at least 2 stop fail because news drove price before the market opened and took price below my stop loss order. One I let fire, and the other I paused for 3 days.

CAT is by far my best run and maybe if I’m lucky, it will be my longest and best in the end. KOG is getting off to a nice start and I can only hope that it will stretch it’s legs before it decides to rest or reverse. Lastly, UA was looking as if I was going to lose that position also, but Friday UA made a big upside move and almost in the stop loss money. I could close all positions now and end with a small profit. Not interested.