This afternoon after the market closed, Apple reported earnings. I have been taught that in most cases that it is never a good idea to buy a stock 1 or 2 weeks before earnings. Sometimes you win and sometimes you lose but it’s never worth the gamble. You can always get in after and ride the safe wave up or down, but stay clear of the drama. I will say, that it feels really good when you buy a stock right before and it just zooms to the sky, but how do you know up or down? You don’t!!!

Best to use methods like trend lines and CBL lines to get in and out and that will normally protect you. Tomorrow morning when Apple opens, if the overnight numbers hold, Apple is going to be greeted to a 50 or more point drop of at least 10%. I do not even know what the news or numbers were that were reported, but it doesn’t really matter. That is going to hurt a lot of feelings.

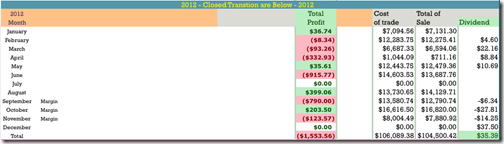

After Hours Chart Below