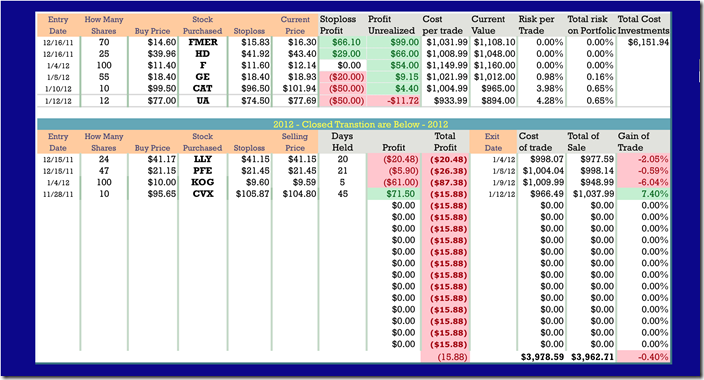

Today I got bounced out of CVX, Chevron after holding it for 45 days. That is a long time for me and I was hoping that it would be a long term hold, but things just didn’t work out. First, $110 has been a major point of resistance since March 28, 2011. Yes, that is a long time and CVX ran back up to that point this week and bounced lower. Not a good sign. Then today the company announced that they expect earnings this year to fall 21%, so down she went. My stop loss order failed to fire at the correct level because the news hit before the market opened, so I got a lower price, but that’s ok, I made a 7% profit. Now looking at it from a technical stand point, 4 definite sell signals were fired this morning, so no regrets here. My green uptrend line was violated. Parabolic SAR did a cross and fired a sell signal. MACD and Chande Momentum Oscillator also fired.

Today I got bounced out of CVX, Chevron after holding it for 45 days. That is a long time for me and I was hoping that it would be a long term hold, but things just didn’t work out. First, $110 has been a major point of resistance since March 28, 2011. Yes, that is a long time and CVX ran back up to that point this week and bounced lower. Not a good sign. Then today the company announced that they expect earnings this year to fall 21%, so down she went. My stop loss order failed to fire at the correct level because the news hit before the market opened, so I got a lower price, but that’s ok, I made a 7% profit. Now looking at it from a technical stand point, 4 definite sell signals were fired this morning, so no regrets here. My green uptrend line was violated. Parabolic SAR did a cross and fired a sell signal. MACD and Chande Momentum Oscillator also fired.

KOG, Kodiak Oil & Gas I bought on 1/4/12 when it broke out above the Bull Flag. I set my stop loss just below my entry and got bounced out 1/9/12 for a 6% loss that hurt a bit. Today more damage was done in the stock in that price broke below the uptrend, PSAR fired a sell, Macd fired a sell on 1/9/12, and lastly the CMO is getting ready to cross below zero. One more important point is that price also broke below the last pivot low and with this many things screaming sell, I guess it was time to just watch this stock for another point of entry. If you own it, I would consider highly taking your profits and wait for another entry.

KOG, Kodiak Oil & Gas I bought on 1/4/12 when it broke out above the Bull Flag. I set my stop loss just below my entry and got bounced out 1/9/12 for a 6% loss that hurt a bit. Today more damage was done in the stock in that price broke below the uptrend, PSAR fired a sell, Macd fired a sell on 1/9/12, and lastly the CMO is getting ready to cross below zero. One more important point is that price also broke below the last pivot low and with this many things screaming sell, I guess it was time to just watch this stock for another point of entry. If you own it, I would consider highly taking your profits and wait for another entry.

GE is starting to stall and I moved my stop loss in tight so I would not take a big loss in the position. The PSAR fired a sell two days ago and now the MACD fired a pink down arrow sell and the MACD lines are squeezed tightly together. The uptrend is still holding and price has not violated anything yet, but even price looks to be stalling. The CMO is starting to turn down and this to brings in concern. The only positive that I can take away from this chart is that both moving averages are still climbing. I do not think it will take much for this to fall, but as long as the S&P 500 continues to climb, GE will likely continue to climb. Just be careful here and do not give back to much profit.

GE is starting to stall and I moved my stop loss in tight so I would not take a big loss in the position. The PSAR fired a sell two days ago and now the MACD fired a pink down arrow sell and the MACD lines are squeezed tightly together. The uptrend is still holding and price has not violated anything yet, but even price looks to be stalling. The CMO is starting to turn down and this to brings in concern. The only positive that I can take away from this chart is that both moving averages are still climbing. I do not think it will take much for this to fall, but as long as the S&P 500 continues to climb, GE will likely continue to climb. Just be careful here and do not give back to much profit.

Two days ago Caterpillar finally busted through $98.20 and it did it with volume to confirm it. I have been burned a few times with Cat, so I was waiting for that level to be broken. I believe that the measured move from the channel breakout if I did it correctly should push CAT to $110 before it slows to much. The next major level of resistance will be $112.

Two days ago Caterpillar finally busted through $98.20 and it did it with volume to confirm it. I have been burned a few times with Cat, so I was waiting for that level to be broken. I believe that the measured move from the channel breakout if I did it correctly should push CAT to $110 before it slows to much. The next major level of resistance will be $112.

Last stock I want to talk about is Under Armor. I have been watching this stock for a long time and today I pulled the trigger and put it in my portfolio. UA at first glance appears to be in a down trend, but there are a lot of indicators telling a different story. On the Weekly chart not shown, the 10 and 30 day moving average never crossed indicating a sell. On the daily chart the most important signs is the higher pivot low and todays price closed above the last pivot high. So now we are guaranteed and higher pivot high somewhere down the road. Now if we supplement price indicators with our oscillators, we have several confirmation to help us decide to buy. The PSAR fired a buy the first day of the trading year. The CMO fired off on 1/9/12 and the MACD fired off 12/29/11 in December. The Stochastic fired on 1/4/12. So after todays break above the last high, I decided enough was enough and took a chance with UA. The risk for me on UA on a single transaction is 4.28%, but my total risk on the entire investment portfolio is just .68%. I think that is worth the risk.

Last stock I want to talk about is Under Armor. I have been watching this stock for a long time and today I pulled the trigger and put it in my portfolio. UA at first glance appears to be in a down trend, but there are a lot of indicators telling a different story. On the Weekly chart not shown, the 10 and 30 day moving average never crossed indicating a sell. On the daily chart the most important signs is the higher pivot low and todays price closed above the last pivot high. So now we are guaranteed and higher pivot high somewhere down the road. Now if we supplement price indicators with our oscillators, we have several confirmation to help us decide to buy. The PSAR fired a buy the first day of the trading year. The CMO fired off on 1/9/12 and the MACD fired off 12/29/11 in December. The Stochastic fired on 1/4/12. So after todays break above the last high, I decided enough was enough and took a chance with UA. The risk for me on UA on a single transaction is 4.28%, but my total risk on the entire investment portfolio is just .68%. I think that is worth the risk.

No comments:

Post a Comment