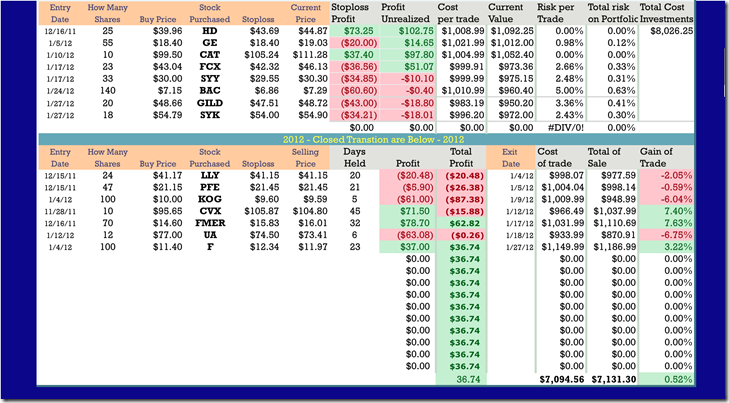

First up is Bank of America. After it reported earnings I decided I wanted this stock but finding an entry was hard. So I just decided on the 24th to make my entry and keep the trailing stop tight in case I was wrong and was going to be burned. One thing to take notice on this chart is the little blue dots under price. This is something I ‘m looking at that will give me a good trailing stop starting point in case I do not have a pivot low to build off of. Below is my risk numbers for BAC. .63% on total investment, that’s tight.

First up is Bank of America. After it reported earnings I decided I wanted this stock but finding an entry was hard. So I just decided on the 24th to make my entry and keep the trailing stop tight in case I was wrong and was going to be burned. One thing to take notice on this chart is the little blue dots under price. This is something I ‘m looking at that will give me a good trailing stop starting point in case I do not have a pivot low to build off of. Below is my risk numbers for BAC. .63% on total investment, that’s tight.

Next is Ford. The earnings report on Ford hit Friday and it did not live up to expectation but overall it wasn’t that bad. But, sellers stepped in and drove price down well below my stop loss. I was forced to take a 3% profit and put Ford back in my watch list. I will be watching this stock closely next week because I want it back if it can reverse and create a new higher pivot low. I like Ford and I still think it is in the beginning of a long term uptrend.

Next is Ford. The earnings report on Ford hit Friday and it did not live up to expectation but overall it wasn’t that bad. But, sellers stepped in and drove price down well below my stop loss. I was forced to take a 3% profit and put Ford back in my watch list. I will be watching this stock closely next week because I want it back if it can reverse and create a new higher pivot low. I like Ford and I still think it is in the beginning of a long term uptrend.

Next up is GLID. I hate trying to find a entry point on stocks when they run like this. I missed the true entry which was December 27th – 29th and since that point nothing but uphill everyday. So what normally happens when I finally do pull the trigger on trends like this, is that I call the top and it reverses. I do not think I have gotten one of these right yet. With that knowledge, I should have just stepped aside, but instead I pulled the trigger Friday and put my stop loss order on what looked to me like the last resistance when it was broken. I have a .41% risk on entire portfolio and 3.36% risk on this one transaction. I feel pretty safe because of the small consolidation and breakout that I highlighted on the chart. Another thing that I know I shouldn’t do is buy right before earnings and GILD reports next Thursday 2/2/12. So if this transaction doesn’t pan out, who you gonna blame? Uh, me!!

Next up is GLID. I hate trying to find a entry point on stocks when they run like this. I missed the true entry which was December 27th – 29th and since that point nothing but uphill everyday. So what normally happens when I finally do pull the trigger on trends like this, is that I call the top and it reverses. I do not think I have gotten one of these right yet. With that knowledge, I should have just stepped aside, but instead I pulled the trigger Friday and put my stop loss order on what looked to me like the last resistance when it was broken. I have a .41% risk on entire portfolio and 3.36% risk on this one transaction. I feel pretty safe because of the small consolidation and breakout that I highlighted on the chart. Another thing that I know I shouldn’t do is buy right before earnings and GILD reports next Thursday 2/2/12. So if this transaction doesn’t pan out, who you gonna blame? Uh, me!!

Last is SYK. On a Weekly chart SYK is breakout right now and is going to give a buy signal Monday. On the daily chart I’m way behind the curve and should have bought this stock about the same time I should have GILD above. That’s ok, at least this time I’m buying after earnings and all I have to fear here is that price might give back some of the surge in price that happened the day of earning were reported. I waited one day after thinking there would be some profit taking, and there was, then on day two I was just looking for a little strength after the 10am point of the day. I pulled the trigger and set my stop loss order with a .3% overall risk and with a single transaction risk of 2.43%

Last is SYK. On a Weekly chart SYK is breakout right now and is going to give a buy signal Monday. On the daily chart I’m way behind the curve and should have bought this stock about the same time I should have GILD above. That’s ok, at least this time I’m buying after earnings and all I have to fear here is that price might give back some of the surge in price that happened the day of earning were reported. I waited one day after thinking there would be some profit taking, and there was, then on day two I was just looking for a little strength after the 10am point of the day. I pulled the trigger and set my stop loss order with a .3% overall risk and with a single transaction risk of 2.43%

Below you will find my current status for the year and like I always say, if they will not show you their true progress, walk away because you know they blowing smoke up your………

No comments:

Post a Comment