Jumped back into the markte today with KORS and GIS. Last Friday I bought Ford. I'm also sniffing on Apple.

Monday, April 29, 2013

Wednesday, April 10, 2013

Tuesday, April 9, 2013

Added another position, BX

After watching this for awhile and after being in a bull flag for bit, it broke out. Yesterday was the breakout and today was the follow through and I stepped in.

Monday, April 8, 2013

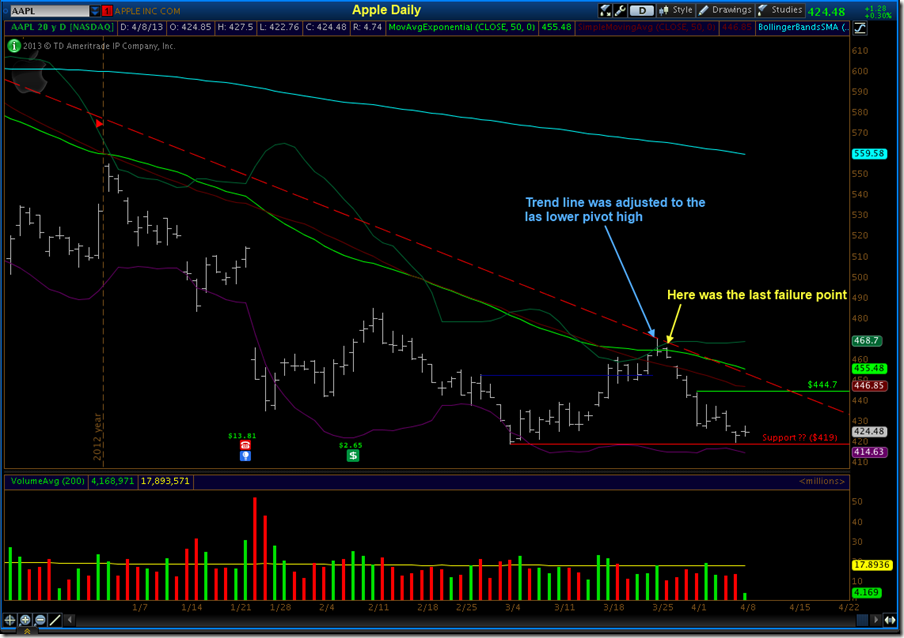

Apple once again failed, so this is where we are.

Down trend was adjusted to last lower pivot high. Looks like support might actually be building for real this time at $419. $444 or higher is looking like the buy level. This is still a watch and a work in progress.

Sunday, March 31, 2013

Current holding update, 3/31/13

This is an exercise for me to ensure that I do not hold a stock for any reason other than to make me money.

BV down 11%. Portfolio risk 1%

CBI up 11.81%. See no reason to sell, just chase with CBL.

Deck up 6.5% and see no reason to sell. Chase with a CBL. Target price $100 a share via Jefferies.

FBHS up 12% and appears to be consolidating at this moment. No reason yet to sell. Even CBL safe.

GWR up 29% and it did threaten a sell recently, but appears to be reversing to the trend. Still my biggest winner and longest hold at 166 days.

PCL is just ripping and I’m just chasing with the CBL. Up 4.5%

RWT up 4.8%. I thought this was going to get stopped out but RWT has made a nice reverse creating a higher pivot low.

SCI up 1.89% and slowly marching higher. Just chasing with a CBL.

My unrealized gain at this moment is 7.57% and YTD gain is a loss of .26% or $56. I sold CI and CSE because they were going sideways and I needed the cash to put into a winner, DECK. Right all stoploss CBL’s are safe. All uptrend lines and 50 day ma’s are safe. Almost scary!

Almost Apple, Almost.

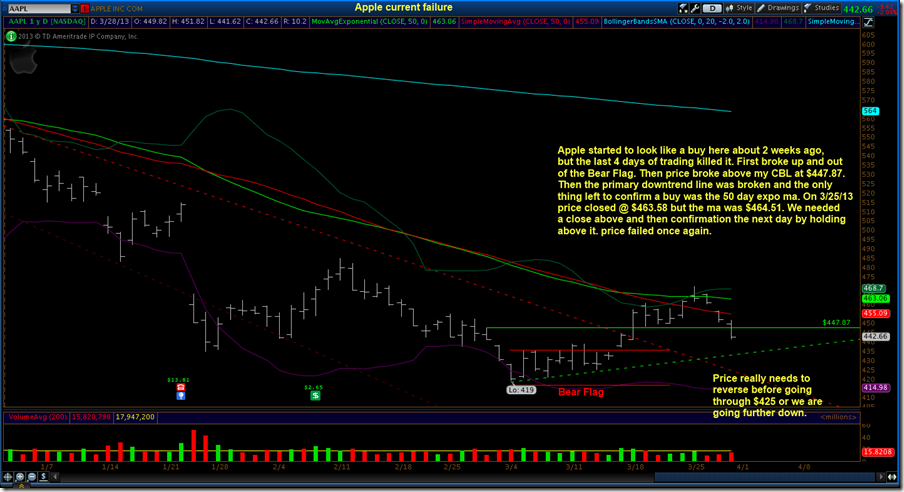

I was ready to pull the trigger on Apple then last week my rule book stopped me from making the purchase. The stock price since September 2012 has taken a beating. Let me show you a picture first before I continue.

I have done a lot of homework on buying and selling and I’m still a work in progress but discipline and greed must always be worked on forever. I recently read another traders point of view and I would like to share it. Click Here for that article. The chart above almost perfectly represents what was said in that article but it has my selling points, not his, marked on the chart. You can read my notes on the charts and my point to this fall and it holds true with any stock you buy, is why hold it until it gives you a reason to own it. Next I will show you a zoomed in view of the area to the lower right where I almost bought Apple for myself.

Most of my notes are on the chart but the point is once again, why buy or hold this stock or any other until it gives you a reason. I will continue to watch Apple and if it ever gives me a reason, I will buy it. Today is not the time.

Friday, March 29, 2013

Tsp Numbers for the first quarter 2013

My TSP account balance has increased in size by $78,000 from 1/1/2013 - 3/31/13. That is a 12.1% increase for 3 months. Year over Year, my account has increased in value by $120,707 or 19.9%.

My exact number is a mystery. :)

One more note, if I had been all G(T-bills), for the last year, I would be up $8,800 for the year. I think learning how to manage risk is worth the risk.

Wednesday, March 27, 2013

Monday, March 25, 2013

AAPl is almost there.

Monday, March 18, 2013

Apple is setting up.

I have been patiently waiting with Apple looking for a reversal and not a bottom. It has teased and head faked several times since September 2012. Now it is back at it and this time is not much different the past moves, but it is a move, so we have to watch it. The current bear flag is beginning to fail because we popped out the top last Friday and today, even though the overall market is down, Apple is up and confirming out of the bear flag. That is plus 1. The next item of interest here is that it just barely trading above my CBL buy line. Now the rules out, first we close above the CBL and then wait until the next day for confirmation. Meaning that price goes higher the next day and or stays above the CBL the next day. Plus 2. Now the last thing that I personally need to see is price to close above the 50 day moving average and then confirm the next day. Looking at the buy zone box I drew on the chart above, you will see the 50 day moving is still above price but tomorrow and beyond, the 50 day is going to move into that box. Plus 3, maybe.

Ok, so Apple is watch and maybe, just maybe, she has found a bottom. Wait for it.

Saturday, March 16, 2013

Weekly Stock report, 3/15/13

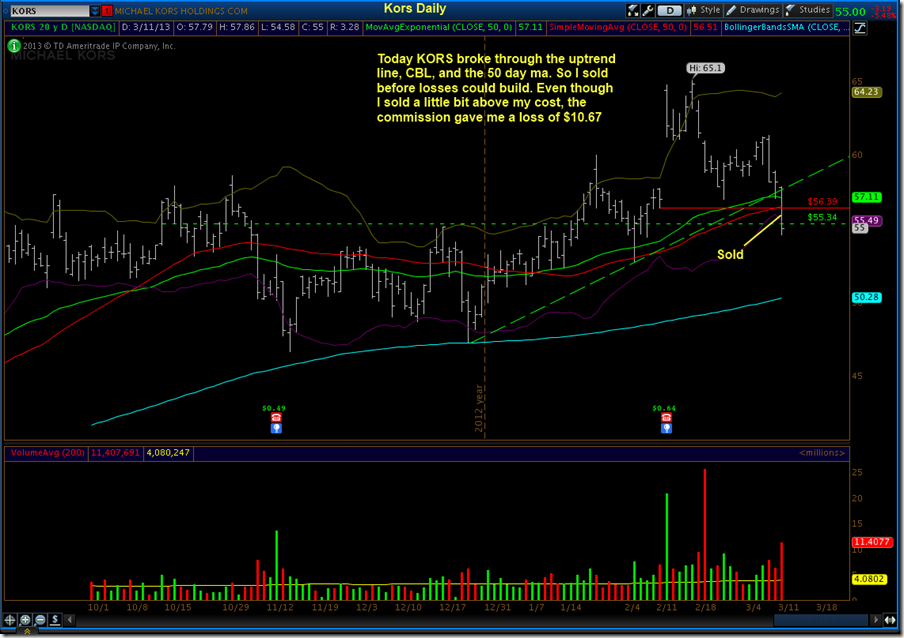

Well I made some moves this week and it cost me my small profit that I had going into the week. I only had a $48 profit for the year going into the week so it would not have taken much to put me below water. AN, was turning against me and even though it never gave me an official sell signal, the trend looked bad. At the same time my purchase in RWT was on such a nice roll, that when I sold AN, I put that money directly into RWT and now it is my largest position. I also sold KORS when it fell below my CBL stop loss. So, a $10 loss on KORS and $92 loss on AN has put me back in my familiar territory.

Ok, below will be a chart for every position I own and notes will be on the charts. Also below will be my current numbers for the year.

YTD profit = ($56.51) –.31%

Unrealized profit = $1045.27 = 5.45%

Tuesday, March 12, 2013

Monday, March 11, 2013

Sold KORS

Meh!! I held this stock from October 2012 and ended up with a $10.67 loss after commission. I was up, then down, the up, and then finished down. What a roller coaster KORS was for me. I still believe because of all the money they are making it will zoom in time. The time was just not right now. So, back into the watch list and maybe I will get another shot in the future.

Saturday, March 9, 2013

Current positions and my review.

I should start doing this every week but time restraints sometimes put a kink in what I want to do. Tonight, I have the time. My current portfolio cost is 16,035.00 including the buy commission. Current unrealized profit is $741, which gives me a 4.62% gain after selling commission. Actual profit realized for 2013 YTD = $46.28. Lot’s of work for that small amount but it is part of my education and right now my education paid me. One more note, my first two sells this year I carried over from 2012 and that put me behind to start the year. Since those 2 sales, I have sold 6 stocks in a row for wins!!!

This past week AN broke the CBL line to the upside and I took the signal and jumped in, 3/8/13. Since that point, price has faded a bit but not below any of my important points. I put a lot of weight in the 50 day moving average and price is still holding above this but there are issues. The uptrend line and CBl are both below the 50 day moving average and this is what I hate about stock buying. To me this is the worst part. Buying and then waiting/hoping that the stock goes up enough to just cover my commission. So the first few days and weeks are always the most painful because I hate selling anything for a loss. Ok, rules are rules, if all 3 fall, I will sell, lick my wounds and move on. I like the bottom line numbers on the stock so let’s hope that it hasn’t fallen out of favor yet. Holding until $43.03 is broken on the downside. Currently down 3.21%.

CSE is another new position that I bought this week, 3/8/13. Volume looks solid but that rising channel will not likely hold up much longer. 3 more up days should put my CBL in the money, so I will hope for that. Look at the chart and it is easy to see I’m in for the ride. No thinking here. Currently down .35%

Deck I bought and sold for profit. When earnings came out, I sold and in hind sight I should have held the position. But I made my mind up that I was going to sell it and I did. Then a ratings firm set a target price of $65 and price started to climb. I made the decision to get back in 3/5/13 and now it looks like volume is trailing off and I do not like that. Ok, so now we will watch all the important levels, CBL, trend, and 50's and if the break, I will be forced to sell and give back my profit. Not to concerned at this moment in time. Currently up .63%.

GWR is my best holding at the moment and I purchased this stock October 16th, 2012. I would still be a buyer here because everything is still working. Volume doesn’t seem to matter. CBL, uptrend and 50’s are all good. Currently up 27.78%

KORS I have owned since October 2012 and it has been a roller coaster. Bottom line, this company is making money hand over foot, but that doesn’t matter unless the stock price goes up. I do not care how great a company is, if it falls out of favor, you will lose money. Take a look at Apple. I think this week that price is going to have to reverse or my sell signals are going to fire and I will have to close the position. Currently up 4.05%

PCL was bought this week, 3/5/13 when it broke out of a bull flag. I didn’t do it with a volume increase, so I may be in trouble. Not that it always matters, but it does help to stack the cards in your favor. Price is still safe above my CBL, Trend line, and 50 day ma. Not to concerned here. Currently down 1.43%

Wednesday, March 6, 2013

Sold SWHC

Sold SWHC for 7.2% profit. Lot’s drama holding this stock because of the price movement and the news of the Sandy hook shooting. Since Obama and all Government seem to want once again put restrictions on guns, people started buying guns like crazy. The earnings report was incredible. 3 times large than normal and future earning expectations were raised. Stock price the day of earnings? Down 4.6%. I’m ok with that, because I put $217 in my pocket.