Jumped back into the markte today with KORS and GIS. Last Friday I bought Ford. I'm also sniffing on Apple.

DIX STOCK BLOG

Monday, April 29, 2013

Wednesday, April 10, 2013

Tuesday, April 9, 2013

Added another position, BX

After watching this for awhile and after being in a bull flag for bit, it broke out. Yesterday was the breakout and today was the follow through and I stepped in.

Monday, April 8, 2013

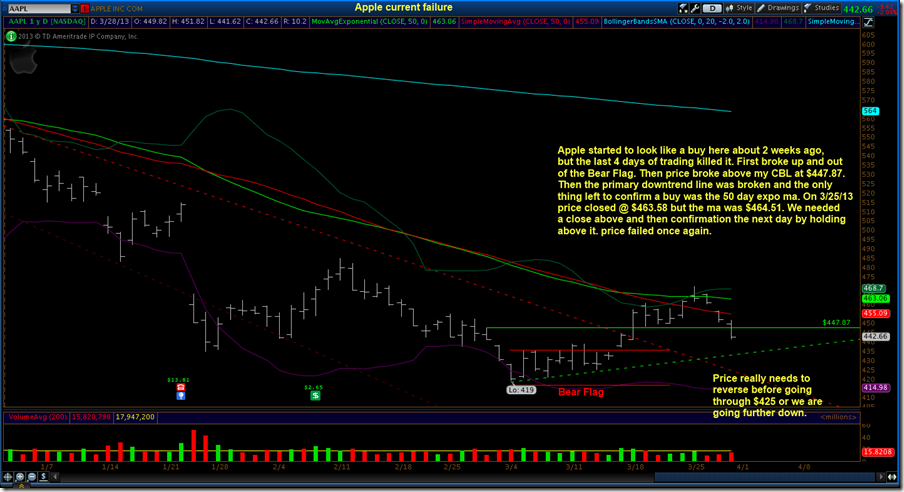

Apple once again failed, so this is where we are.

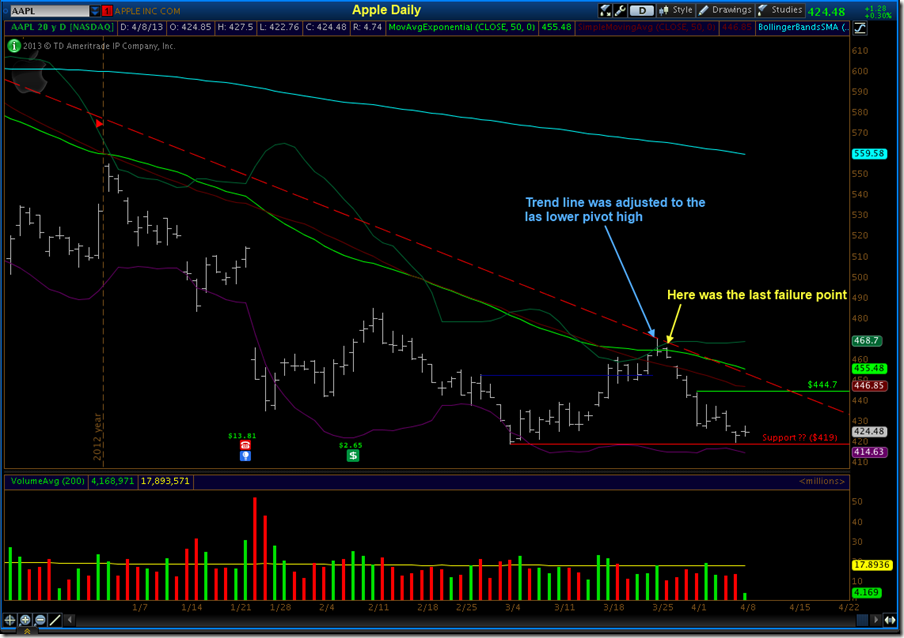

Down trend was adjusted to last lower pivot high. Looks like support might actually be building for real this time at $419. $444 or higher is looking like the buy level. This is still a watch and a work in progress.

Sunday, March 31, 2013

Current holding update, 3/31/13

This is an exercise for me to ensure that I do not hold a stock for any reason other than to make me money.

BV down 11%. Portfolio risk 1%

CBI up 11.81%. See no reason to sell, just chase with CBL.

Deck up 6.5% and see no reason to sell. Chase with a CBL. Target price $100 a share via Jefferies.

FBHS up 12% and appears to be consolidating at this moment. No reason yet to sell. Even CBL safe.

GWR up 29% and it did threaten a sell recently, but appears to be reversing to the trend. Still my biggest winner and longest hold at 166 days.

PCL is just ripping and I’m just chasing with the CBL. Up 4.5%

RWT up 4.8%. I thought this was going to get stopped out but RWT has made a nice reverse creating a higher pivot low.

SCI up 1.89% and slowly marching higher. Just chasing with a CBL.

My unrealized gain at this moment is 7.57% and YTD gain is a loss of .26% or $56. I sold CI and CSE because they were going sideways and I needed the cash to put into a winner, DECK. Right all stoploss CBL’s are safe. All uptrend lines and 50 day ma’s are safe. Almost scary!

Almost Apple, Almost.

I was ready to pull the trigger on Apple then last week my rule book stopped me from making the purchase. The stock price since September 2012 has taken a beating. Let me show you a picture first before I continue.

I have done a lot of homework on buying and selling and I’m still a work in progress but discipline and greed must always be worked on forever. I recently read another traders point of view and I would like to share it. Click Here for that article. The chart above almost perfectly represents what was said in that article but it has my selling points, not his, marked on the chart. You can read my notes on the charts and my point to this fall and it holds true with any stock you buy, is why hold it until it gives you a reason to own it. Next I will show you a zoomed in view of the area to the lower right where I almost bought Apple for myself.

Most of my notes are on the chart but the point is once again, why buy or hold this stock or any other until it gives you a reason. I will continue to watch Apple and if it ever gives me a reason, I will buy it. Today is not the time.